Accident, Critical Illness, and Hospital Indemnity coverage are available to you, your spouse, and your dependent children. However, employees must have coverage in order for their spouse and children to obtain coverage.

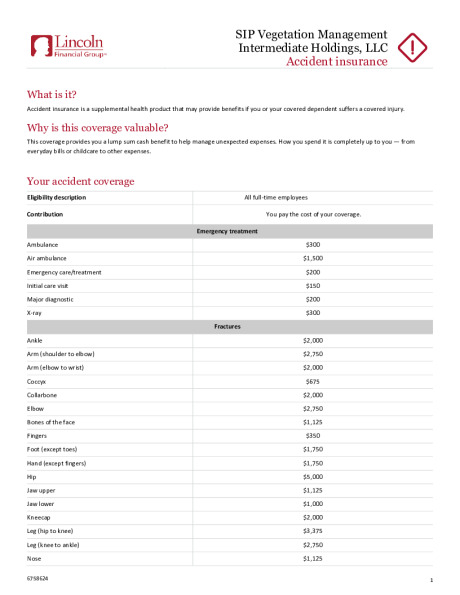

Accident Insurance

No one plans to have an accident but it can happen at any moment throughout the day, whether at work or at play. Most major medical insurance plans only pay a portion of the bills. This policy through Lincoln Financial Group, can help pick up where other insurance leaves off and provide cash to cover the expenses. Our accident coverage helps offer peace of mind when an accidental injury occurs.

Below is a brief summary of benefits. Please see your benefit summary for more information about this coverage.

Summary of Benefits:

- Initial care visit $150

- Ambulance $300

- X-ray $300

- Air ambulance $1,500

- Emergency care / treatment $200

- Major diagnostic $200

Accident Insurance Plan Documents

Accident Insurance

Critical Illness Insurance

Critical Illness coverage through Lincoln Financial Group, provides a lump sum benefit following major diagnosis like cancer, kidney failure, heart attacks, or stroke. This benefit can be used to help cover expenses that your insurance does not, such as bills, groceries, or transportation.

Below is a brief summary of benefits. Please see your benefit summary for more information about this coverage

Coverage Amounts:

- Employee – $10,000

- Spouse – $5,000 up to 50% of employee benefit amount

- Children – 50% of your coverage amount at no extra cost

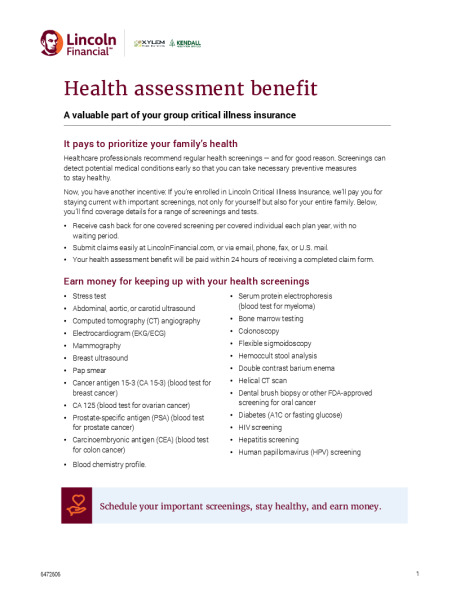

- Health Assessment/Wellness Benefit*: Level: $50

* You receive a cash benefit every year you and any covered family members complete a single covered exam or screening.

Critical Illness Insurance Plan Documents

Critical Illness Insurance

Hospital Indemnity Insurance

Hospital Indemnity coverage through Lincoln Financial Group, helps deliver financial security for the unexpected—allowing you to help protect your budgets against unforeseen expenses if you suffer an accidental injury or sickness. You can use the cash benefits from this coverage to help meet copayments, to pay for recovery expenses or in any way you see fit. Below is a brief summary of benefits. Please see your benefit summary for more information about this coverage.

Summary of Benefits:

- Hospital Admission: For the initial day of admission to a hospital for treatment of a sickness/an injury – $2,000 per day for one day per calendar year.

- Hospital Confinement: For each day of confinement in a hospital as a result of a sickness/an injury – $200 per day for 30 days per calendar year (starting on day 2).

- Hospital ICU Confinement: For each full or partial day of confinement in an ICU as a result of a sickness/an injury – $400 per day for 30 days per calendar year (starting on day 1).

- Newborn Care: For each day of confinement to a hospital for routine postnatal care following birth – $200 per day for two days per calendar year.

- Health Assessment/Wellness Benefit*: Level: $50

* You receive a cash benefit every year you and any of your covered family members complete a single covered exam, screening, or immunization.